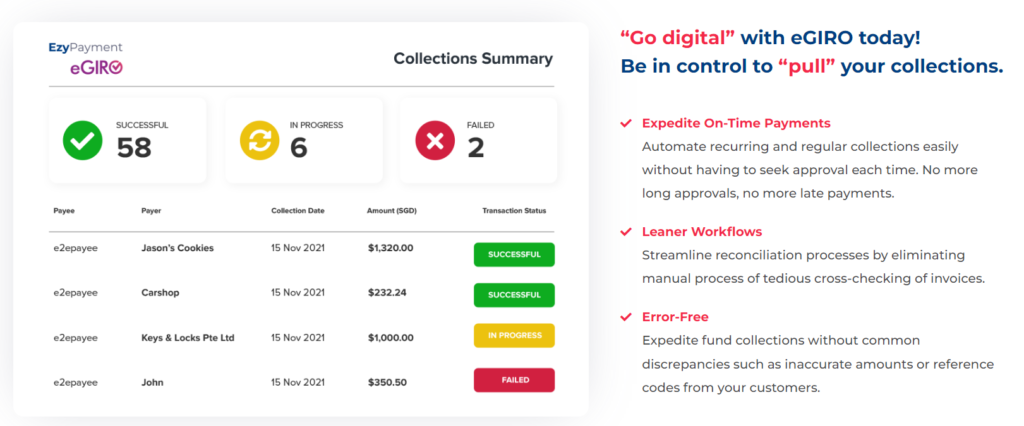

A tuition centre’s woes of collecting tuition fees and matching each payment with its customers have ended. All thanks to switching from using PayNow to EzyPayment eGIRO, a service offered by Singapore E-Business (SGeBIZ), a fintech company and a major payment institution licensed under the Monetary Authority of Singapore.

When it comes to collections and getting paid on time, eGIRO is not only a cost-effective but also a cost-efficient platform for billing organisations to collect payments from consumers and corporates. The process becomes more digitised, efficient and seamless. For businesses, the advantages of using eGIRO in their business operations are manifold and obvious.

“With EzyPayment eGIRO, I no longer need to chase for payments, I will just need to set up the payment once, and I can receive all the subsequent payments automatically. For PayNow, a transaction still needs to be made every month. EzyPayment eGIRO has definitely saved me a lot of time and effort to monitor who has paid and who has not,” said Mr Maverick Puah, owner of tuition centre, Chemistry Guru.

“I think e-payment like eGIRO is beneficial to both customers and the company. It never occurred to me that this can be applied to tuition centres,” added Mr Puah.

“eGIRO has automated my recurring payments for my child’s tuition fees at Chemistry Guru and I receive email notifications whenever a payment is made,” enthused a parent. “Just follow a couple of steps for a simple one-time set-up. There is no need to print and fill in a physical GIRO form and I don’t have to remember to do a bank transfer or PayNow every month,” added the parent.

SGeBIZ, as a payment aggregator and a provider of B2B business solutions, helps business organisations to adopt eGIRO and enhance their productivity. There will be no more late payment charges for recurring bills. The process is automated and fuss-free. This one platform will incorporate multiple billing organisations and will provide a consolidated digital view of recurring GIRO payments.

eGIRO helps consumers to save time, especially from repeat PayNow or ibanking transfers to regular service providers. The process also enables consumers or organisations to cancel eGIRO arrangements with only one click and within minutes. eGIRO is a secure and reliable digital payment method, supported by the major banks in Singapore.

eGIRO transforms the paper, manual process of GIRO into a digital, eco-friendly experience. Unlike current paper GIRO applications which require weeks to be processed and approved, consumers and businesses can now make arrangements to pay their bills in minutes.

Mr Edmund Louis Nathan, Founder & Group CEO of Singapore E-Business Pte Ltd, said: “Since the launch of eGIRO by the Association of Banks in Singapore in November last year as part of the Smart Nation initiative, we have been supporting our customers who have been onboarded to our platforms. This has enabled our customers to electronically seek direct debit mandates and collect money seamlessly within the SGeBIZ ecosystem. We are focused on helping businesses accelerate their growth in the digital economy through innovative solutions in integrated payments, financing and value-added services.”

SGeBIZ’s EzyPayment eGIRO platform will enable its customers to reduce costs, gain greater operational efficiency, streamline workflow as well as improve liquidity and cash flows. An additional advantage of using EzyPayment eGIRO is the reconciliation process. EzyPayment eGIRO will help SGeBIZ’s customers streamline their payment, collections and reconciliation work processes. This will help to eliminate errors and provide a leaner financial management process.

Here at SGeBIZ, we believe in nurturing every individuals to empower them with the skillsets and capabilities to excel in their field. Hear from our interns’ experiences on how the guidance and exposure in SGeBIZ have helped to build their future careers.

As a Customer Success Intern at SGeBIZ, I was given room to grow and work independently under the guidance of my department and peers.

With my focus on increasing customer satisfaction, I spoke to our customers to gather feedback on the company’s products and how they could be improved. I also worked alongside the IT team to explore how we could speed up the onboarding process for our customers, increasing the efficiency of our Customer Success operations. In addition, I worked closely with the Marketing team to head our Customer Engagement activities to actively engage our existing customers, including planning and executing content for Customer Recognition Awards.

My internship experience was definitely a fruitful and enjoyable one. It would not have been possible without the guidance from my colleagues, as well as them always being so friendly and approachable. Thank you, SGeBIZ, for everything!

My internship with SGeBIZ as a Digital Marketing Intern has been a fulfilling one! During my time here, I was fortunate to have had the support and guidance of a patient team, as well as opportunities to grow and to learn more about the fintech industry.

The team was supportive of my interests in writing and gave me opportunities to further my experience in content creation through copywriting. I was given the scope to prepare the content copy of the company’s social media posts, EDMs, and marketing materials to promote our business solutions and participation at events. This allowed me to gain a look-in to B2B content writing, and further my copywriting experience.

Beyond this, I am grateful to have been given opportunities to dabble in areas of video production and event planning, which I believe will contribute greatly to my experience as a Communications undergraduate.

Thankful for the welcoming team I’ve met during my time here!

Reflecting on the past 10 weeks, my internship with SGeBIZ has been nothing short of fulfilling! As a Business Development & Growth Intern, I helped with sales-led initiatives from lead generation to closing deals. I was also involved in the research and analysis of strategic areas like the company’s growth plans and growing and identifying partnerships with key clients with whom we have product and company synergies.

All these have allowed me to gain good exposure to the Fintech industry and deeper insights into B2B procure-to-pay solutions and what goes on behind the scenes to keep a Fintech company dynamic and innovative.

Most importantly, the culture in SGeBIZ is excellent! I am very grateful to the team for their guidance and for being so friendly and approachable. They gave me room to grow, voice my opinions, and work independently. Thank you, SGeBIZ!

If you are interested in finding out more about the latest job openings, visit www.sgebiz.com/careers today.

Looking for an internship? Send your resume to [email protected]

Beloved for its delectable dim sum fare, Yum Cha is a culinary institution that most Singaporeans easily recognise.

Having first opened its doors in 2000 as a humble shophouse eatery along Temple Street in Singapore’s Chinatown district. The company later expanded with a second outlet in Changi Business Park, delivering its unique dining experience to the convenience of more customers.

While business is smooth and well-run today, Yum Cha struggled with operational limitations that arose from cumbersome manual procurement processes just two years ago.

Bound by old systems, Yum Cha found it increasingly difficult to cross-reference vendor prices. Staff also strained to track orders and manage the company’s accounts payables.

Major discrepancies in order placements and accounting emerged, impacting the company’s profits. Yum Cha’s employees also spent excessive amounts of time addressing these issues, distracting them from more productive tasks.

Yum Cha’s management recognised that revamping their procurement processes was key in resolving these problems.

At the recommendation of another fellow restaurant operator, Yum Cha was introduced to SGeBIZ and the benefits associated with their EzyProcure digital platform.

After an in-depth discussion with SGeBIZ’s sales and customer success team, Yum Cha adopted the EzyProcure platform and digitalised its procurement process.

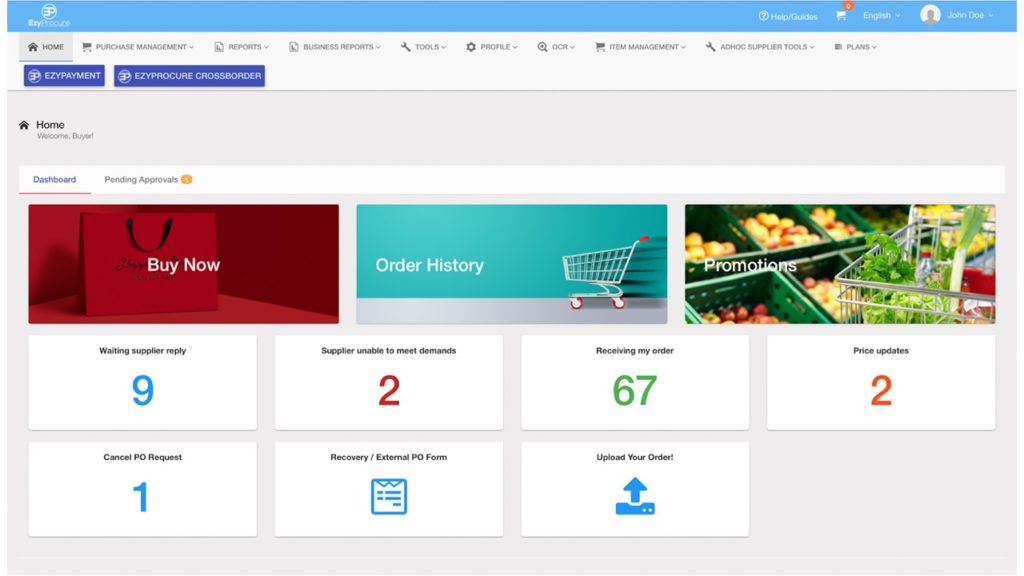

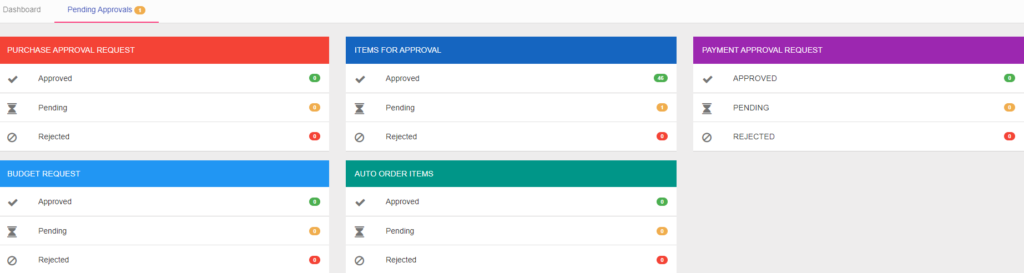

Change can be uncomfortable. However, EzyProcure’s user-friendly features alongside the support from the Customer Success team made the integration between the platform and Yum Cha’s day-to-day operations smooth-sailing.

For one, new users at Yum Cha were quickly acquainted with EzyProcure’s many handy and simple-to-use functions. The company’s employees found it a breeze to not only place online orders but also receive goods and reconcile uploaded documents thanks to EzyProcure’s intuitive user interface.

The availability of major Asian languages also made EzyProcure more appealing to Yum Cha’s operations team, which comprised mostly of Mandarin-speaking staff.

Some hiccups were inevitable, though Yum Cha’s general manager Pamela Wong shrugged them off with credit to the helpful staff. “The transition was slightly challenging initially,” she said. “But the EzyProcure team’s supportiveness and responsiveness greatly eased the onboarding journey.”

Since the adoption of EzyProcure in both Yum Cha’s branches, the software solution has been able to resolve many of the operational challenges they were seeking to improve.

One of these is the auto-reconciliation feature powered by a unique AI-powered OCR technology that performs a 3-way match of the purchase orders, goods receivables and invoices. This improves Yum Cha’s back-end operations and reconciliation work with more speed and accuracy than previously possible.

In addition to this is the added visibility that comes with EzyProcure. Yum Cha can now better control and monitor their orders digitally and produce quality food while cross-referencing prices amongst their different suppliers to ensure they’re getting the best deal for their supplies.

As the procurement process became more efficient, Yum Cha saw the improvements occur in multiple sectors of the company as a direct correlation to EzyProcure.

Apart from merely benefits to their procurement processes, Pamela Wong indicated improvements in inventory data and inventory management as a key improvement.

“Inventory is another factor. We are able to trace the quantities of our orders and compare them to the historical trending against our sales to gauge any irregular fluctuation,” said Pamela.

Besides being able to control the quality, oversee prices and manage their inventory more effectively, they are also able to track profit margins and compare them against previous procurement data — all of which have brought Yum Cha to its good success today.

With EzyProcure, Yum Cha has since significantly reduced time spent on manual back-end processes, including procurement and inventory management. This has enabled them to spend more time focusing on their front-facing operations, as they continue to bring quality food and service to their customers as a familiar name.

As businesses flock to connect and network at in-person events in Singapore this year, Singapore E-Business (SGeBIZ) has also been quick to jump on the bandwagon.

Between 22nd to 24th June, the company participated in the Speciality and Fine Food Asia trade show held at Suntec City Exhibition and Convention Centre.

Drawing in more than 7,300 attendees from 47 countries and an unprecedented 188 exhibitors from 16 countries, Speciality and Fine Food Asia offered a strong forum for SGeBIZ to interact with leading domestic and international food and beverage companies.

SGeBIZ received over 300 visitors to its booth across the entire duration of Speciality and Fine Food Asia.

The event was also endorsed by key industry organisations including the Singapore Food Manufacturers Association, the Singapore Manufacturing Federation, and the Singapore Tourism Board, among others.

This year’s edition also marks the first time that the event was co-located with four other trade shows, including, Restaurant, Pub & Bar Asia, Speciality Coffee and Tea Asia, Meat & Poultry Asia, and Food2Go.

Over the entire event, the company attracted strong interest in its leading-edge solutions such as EzyPayment and EzyProcure from leading food and beverage players like Hard Rock Café, Tipsy Collective, and Café Amazon International.

SGeBIZ also rubbed shoulders with 18 of their existing customers who were also exhibiting at the event. Their mutual presence at this world-class trade show to exhibit our platform enhances our reputation as a trusted partner for business owners looking to digitise their sourcing, procurement, and payment processes.

Speciality and Fine Food Asia isn’t SGeBIZ’s first brush with F&B businesses. To date, the company’s EzyPayment and EzyProcure solutions count more than 3,500 satisfied customers, including casual dining chain EighteenChefs, French restaurant Merci Marcel, and Korean barbeque franchise Seoul Garden.

What makes their solutions so appealing to F&B players?

From order creation and acknowledgement of receipt of goods to generating invoices and reconciliation between F&B outlets, central kitchens and their suppliers – SGeBIZ does it all. Their platform saves F&B businesses up to 70% of their time and cost on daily procurement.

This fully digital process extends to invoicing on a nationwide e-invoicing network, InvoiceNow, as the platform will enable businesses large and small to send their invoices electronically through the network and get paid for their services and products more promptly.

EzyProcure allows F&B businesses to receive real-time notifications on price changes and order fulfilment status from their suppliers. EzyProcure, combined with inventory and a recipe-management solution, also helps track food costs and store inventory, thereby minimising food wastage for F&B businesses.

EzyProcure is a pre-approved vendor under IMDA’s Go Digital Productivity Solutions Grant Program, allowing eligible F&B businesses to enjoy up to 80% grant subsidy.

On the other hand, EzyPayment allows F&B businesses to enjoy extended credit on their existing credit cards and maximise cash flow for their business operations. As interest rates and labour costs continue to surge in Singapore, F&B margins are increasingly being squeezed further. EzyPayment allows F&B businesses the additional breathing space with up to 60 days of interest-free credit when they pay with their credit cards through the platform while suppliers receive payments within a short 2 – 5 days.

SGeBIZ also offers eGIRO as a solution to suppliers to collect money from their buyers as and when the invoices become due. This is a great tool for those suppliers who prefer supplying on cash on delivery (COD) basis.

EzyPayment’s seamless integration with backend enterprise resource planning and accounting platforms also helps F&B businesses better manage their accounting and finances.

Speciality and Fine Food Asia is one out of more than 150 events attended by over 37,000 delegates in just the first quarter of 2022. According to the Singapore Tourism Board, at least 66 more international events have already been secured for the rest of 2022.

That’s already three-quarters of last year’s figures – and a strong sign that Singapore’s Meetings, Incentives, Conventions, and Exhibitions (MICE) industry is surging ahead with a speedy recovery.

As more opportunities to connect with businesses worldwide in Singapore arise, SGeBIZ’s suite of procure-to-pay solutions can address the needs of companies across more industries and is confident it’ll draw many more in other in-person events to come.

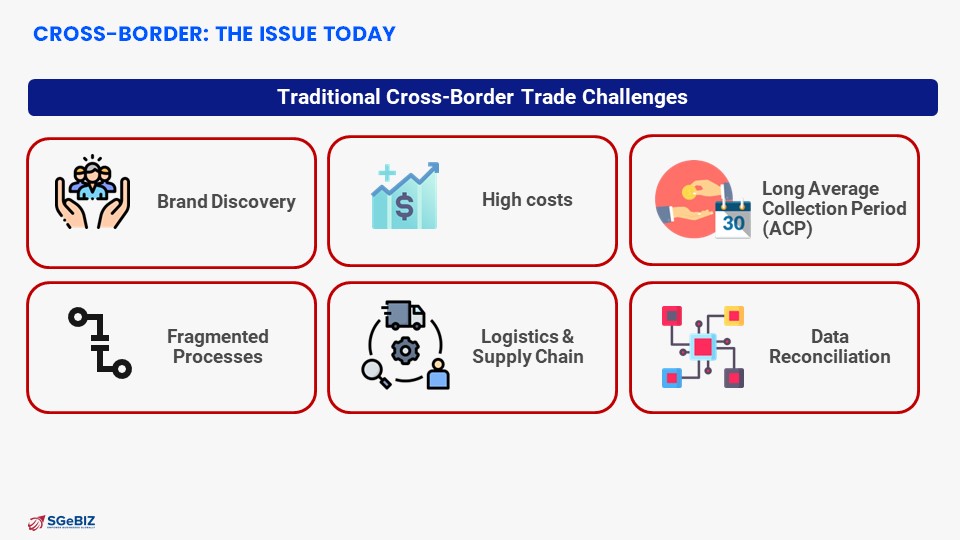

Faced with lower-cost competitors in the region and severe manpower shortages, going digital is essential for Singapore’s food manufacturers. Get end-to-end visibility over your international sourcing, procurement and payment processes with the most complete digital cross border solution.

On May 31st 2022, SGeBIZ participated in the Singapore Business Federation’s Grow Digital Series webinar.

Co-organised with the Singapore Infocomm Media Development Authority (IMDA), webinar participants tuned in to a series of conversations on how businesses can overcome supply chain disruptions by leveraging digitalization and how to sell across borders without a physical storefront.

The event is part of IMDA’s Grow Digital initiative. Launched under the SMEs Go Digital programme jointly organised with Enterprise Singapore, participating SMEs can sell overseas via business-to-business and business-to-consumer e-commerce channels with no physical storefront.

Speaking to an audience of small-medium business owners in the food manufacturing sector, SGeBIZ Chief Operating Officer Benjamin Tay shared how the company’s suite of cross-border solutions can enable them to scale their operations and sell abroad.

For Singapore’s food manufacturers, going digital is essential.

Faced with lower-cost competitors in the region and facing manpower shortages, these businesses can only rely on digital solutions that automate workflows and make procurement more cost effective.

The challenges are aplenty for Singaporean food manufacturers looking to expand operations or export products overseas. With markets like the USA and Vietnam accounting for 25% and 11% of Singapore’s total food product exports respectively, a digital strategy that crosses markets is key to reaching customers beyond the domestic market.

High labour and payment costs aside, businesses also struggle not only in finding partners to support critical processes like end-to-end logistics and permit settlement, but also reconciling data across platforms for invoices.

Without any means to capture market data comprehensively, expansion strategies also fall flat right from the get-go.

This lack of end-to-end visibility makes any overseas venture significantly riskier for food manufacturers.

Globally, just 22% of companies have mapped out their entire supply chains. That figure’s likely to be significantly lower for Singaporean food manufacturers which operate on tighter margins.

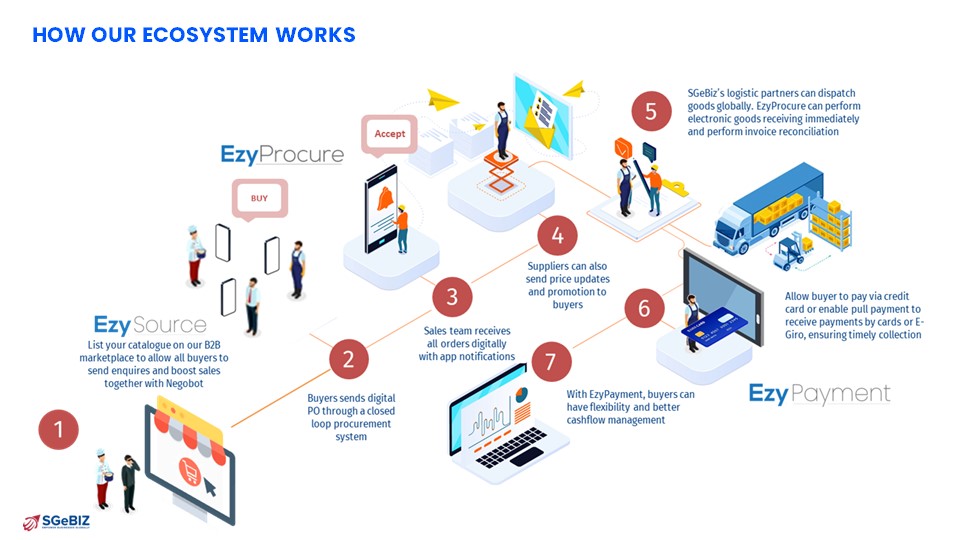

These are familiar pain points to small-medium businesses of all types, said Tay during the webinar. Since SGeBIZ’s establishment in 2014, the company has been diversifying its suite of cross-border solutions to precisely target each of these concerns.

Highlighting how a typical journey begins with sourcing supplies, Tay noted how EzySource, SGeBIZ’s e-sourcing portal, curates suppliers for prospective buyers to easily reach out to at better rates. He adds that both buyers and suppliers can also enjoy greater flexibility on credit and payment terms, and even consummate deals with automatic negotiations.

Next comes procurement. EzyProcure, a one-stop procure-to-pay B2B cloud-based platform, connects buyers and suppliers both domestically and across borders. Equipped with features like optical character recognition and automatic inventory management, food manufacturers can also reduce labor costs by conducting remote operations. Costs from inefficiencies are also minimized thanks to real-time price updates and built-in inventory management analytics.

SGeBiz’s end-to-end cross-border ecosystem also takes care of payments and fulfillment.

With EzyPayment, businesses can pay overseas suppliers in their respective currencies via personal, corporate, or virtual cards, said Tay. “This can be done within the day, up to two days,” he added. Businesses that have used EzyPayment have found their cash flow upped to as much as 60 days.

Via SGeBIZ, food manufacturers can also connect with logistics partners to dispatch products globally instead of having to source one separately. EzyProcure can instantly perform electronic goods receiving and on-the-spot invoice reconciliation.

Few cross-border solutions provide the same end-to-end visibility. From international sourcing, procurement, and payment processes, grow your business digitally with the most complete digital cross-border solution only SGeBIZ offers today.

Make cross-border trade easy. Book a demo with us today.