Born and bred in Singapore, SIMYEE Holdings is a progressive multi-dining concept group offering quality food & beverage experiences across the island.

Born and bred in Singapore, SIMYEE Holdings is a progressive multi-dining concept group offering quality food & beverage experiences across the island.

With 5 popular F&B names, 9 outlets, and one central kitchen, they serve a variety of cuisines including Western, Japanese, and Thai. The local organization has over 8 years of experience in the restaurant operations industry and a fast-growing team of 60 staff members today.

However, before they got to where they are today, let’s rewind back to five years ago when the brand had its hands full with five restaurants to manage.

While they were propelled by the group’s ever-progressing nature and passion for the industry, their founder Mr. Chiam Wee Leong (left) realized that they needed a solution to first ease the bottlenecks in their day-to-day operations before an expansion could take place.

Some of the major issues that SIMYEE Holdings was facing in their initial days stemmed from their procurement processes, which were the meat and potatoes of the whole operations when it came to managing multiple dining outlets.

Due to the company’s manual procurement processes and more traditional workflow structures, there were greater margins for oversights and human error to occur throughout their business.

Apart from not having the means to trace back the purchase orders made by employees, they also found it difficult to stay updated with the fluctuating prices of goods amongst their suppliers.

This ultimately made the accounts payable (AP) reconciliation a burdensome task due to the high amount of data that did not tally when comparing their purchases against invoices sent by their suppliers.

Furthermore, the subsequent process of painstakingly logging all invoices manually into their accounting service platform (QuickBooks), a time-consuming and laborious process, exhausted his employees severely.

With that discovery, Mr. Chiam realized how detrimental these manual processes were to the growth of the company, and understood that digitalization was needed in order for the home-grown brand to soar higher.

In the midst of their search for a procurement solution, Mr. Chiam learned of SGeBIZ and was referred to EzyProcure by another company that had adopted EzyProcure into their own business.

“The first time we connected with SIMYEE Holdings in November 2017, they mentioned that they were sourcing for a procurement management system to address the procurement and Accounts Payable (AP) reconciliation challenges they were facing,” said S. Barathan, General Manager of Customer Success in SGeBIZ.

By adopting a single platform solution that could seamlessly integrate into their existing systems and automate workflows, they were able to cut down the time and effort spent on mundane tasks by up to 70%. Time-consuming tasks such as data entry works were significantly cut down, as AP reconciliation can be done on EzyProcure and data can be seamlessly exported into their accounting platform.

Ultimately, time spent on reconciliation and data entry works fell from up to 3 hours a day to just 30 minutes.

While the single platform solution showed great promise in the long run, the team had to overcome some of the challenges that come with learning any new system.

“There will definitely be challenges, especially when it comes to introducing or implementing a solution kind of system to any F&B business, and for SIMYEE Holdings, there were challenges in terms of adoption and adaptability,” Barathan added.

But with eagerness to learn paired with the relentless support rendered from SGeBIZ, it wasn’t long before the team at SIMYEE Holdings got the hang of digital procurement.

The adoption of EzyProcure required the cooperation of the entire team — which also meant that they had to eliminate manual orders made by employees across outlets and familiarize them all with the new platform. This allowed Mr. Chiam as well as everyone in the organization to easily obtain an overview of all purchase orders, hard copy invoices, and such within a single platform.

“The implementation of EzyProcure has helped SimYee Holdings to streamline our entire procurement processes from electronic ordering to electronic goods receiving and seamlessly exporting all reconciled invoices to our accounting platform,” according to Mr. Chiam.

EzyProcure’s optical character reading (OCR) technology also introduced the concept of automation into their existing workflow.

With the help of the proprietary technology, the finance team in SIMYEE Holdings was able to expedite reconciliation works easily within three to five seconds after an outlet sent a photo of the invoice, instead of having to wait up to two weeks for the physical copy to reach them.

This enabled the team to export invoices easily to QuickBooks without the need to do any tedious data entry work.

“With the OCR technology that EzyProcure has, accounts payable reconciliation cannot become easier,” shared Mr Chiam.

On top of that, the OCR technology is also able to assist the team in identifying price and quantity discrepancies of goods during AP reconciliation. Before the digital implementation, it was cumbersome for the finance team to keep track of previous prices unless they were to flip through stacks of hard copy invoices.

With EzyProcure’s OCR technology, discrepancies can automatically be immediately picked up through the digital invoice after the photo has been sent over by the outlet.

This means that if the supplier did not notify Mr. Chiam of a price update prior to billing, the OCR technology would flag an amount mismatch due to the difference from previous rates.

The other significant advantage that EzyProcure brought to the team at SIMYEE Holdings includes higher visibility of their cash flow management through business reports of their data trends.

With the solution, Mr. Chiam is able to view and segment data based on a variety of filters such as total purchase volume, goods received during a specific period of time, number of sellers selling a specific item, and which outlet making purchases from a specific supplier — making it easier for him to make better-informed business forecasts.

Today, the procurement workflow at SIMYEE Holdings has a much leaner system that’s been enabled by EzyProcure’s paperless technology.

Employees are now able to conveniently place orders for goods via their mobile phones or tablets, which means they are not required to be physically present at the outlet to make an order.

Details on the placed order can then be accessed by everyone through the system, which ensures lesser discrepancies such as placement of double orders, and employees can easily sign to acknowledge that they have received the goods via EzyProcure as well as take a photo of the physical invoice.

“As the EzyProcure interface (both app and web) is extremely user friendly, it allowed our colleagues on the ground to adapt to the application efficiently.”

– Mr. Chiam Wee Leong

Founder, SIMYEE Holdings

“SIMYEE Holdings has been one of our oldest customers, and the working relationship we’ve had over the years has been quite fantastic.”

– S. Barathan

General Manager of Customer Success, SGeBIZ.

Want to learn more about how EzyProcure can help automate your procurement workflow? Click here!

Singapore is a well-known street food hub and hawker stalls are part of the country’s gastronomical identity. This Uniquely Singapore gem is now officially recognized at the global scale, by the way! Singapore hawker culture is listed as UNESCO intangible cultural heritage on 16 December 2020.

Time and again, Singaporeans’ love for food has proved that hawker stalls have a bright prospect and will always be in demand. If you are looking for a career pivot – following the onslaught of the COVID-19 pandemic – or simply looking to seize lucrative opportunities abound in the F&B industry, opening a hawker stall could be worth exploring. Interested yet? This guide is for you!

1. Eligibility

To apply to become a hawker stall business owner, there are only two main conditions:

a) You must be a Singapore citizen or a Permanent Resident, and

b) You must be at least 21 years of age

2. Identify your niche

Laksa, char kway teow, rojak – Singapore is teeming with delicacies! Before starting your hawker stall business, it is crucial to decide on your speciality dish. That way, it will be easier for you to focus on your product development and improvement i.e. making your food good, better and even better! Examples of successful hawker stalls that have found their niches are Hideki at the Yishun Park Hawker Centre and the Lukhon Thai stall at the Pasir Ris Hawker Centre.

3. Perform a SWOT analysis

Before starting a business, you must first do the strengths, weaknesses, opportunities and threats (SWOT) analysis. Be totally honest with yourself and perhaps it will also help to get your mentor or other respected business owner friends/investors on board as you brainstorm.

The SWOT analysis will be insightful to prepare you for the possible future outcomes, minimise risks and maximise the upsides to enhance success.

4. Round up your initial start-up costs

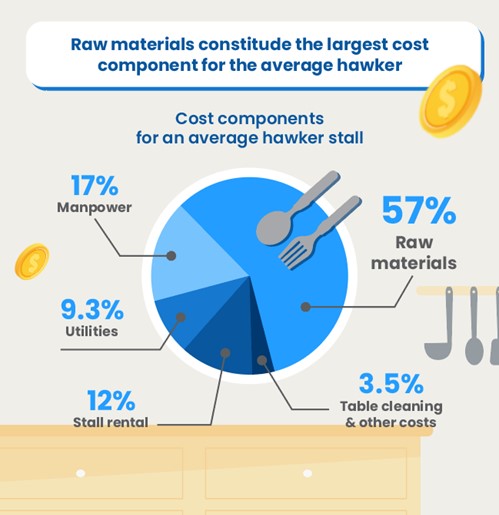

Factor in your monthly rental fee and employee wages – which will make up the largest portion of your business costs. Then, you would need to also include costs of raw materials and supplies. A survey by NEA found that the raw material costs contribute to the bulk of total costs.

Therefore, it is important to source out for the right suppliers and do your calculations carefully beforehand.

5. Identify a suitable location

It is all about location, location, location for a consumer business. For a F&B business, it is even more so about location, location, location! Take the time to research several potential locations to set up your hawker stall business and later narrow it down to the one that has the highest possible foot traffic and most easily accessible, yet well within your budget. Within the consideration factor of the foot traffic is the demographics of your visitors – would your speciality dish be of good appeal to their “foodie consumption” pattern?

6. Leverage grant support programmes

As a way to encourage Singaporeans to become F&B entrepreneurs, the Singapore Government has initiated several grant support programmes for those aspiring to become hawker stall business owners. Among them are :

a) Hawkers’ Development Programme

There are three stages in the Hawkers’ Development Programme:

This initiative will help address problems faced by aspiring hawkers on starting up and make it easier for young hawkers to enter the trade permanently.

To counter succession problems, NEA launched the Incubation Stall Programme to encourage aspiring F&B entrepreneurs to join the hawker trade.

Applying for the Incubation Stall Programme will help you get started in your first step to becoming a successful hawker. It reduces the risk factor to a certain extent, especially if you are a novice to the F&B industry.

c) Productivity Solutions Grant (PSG)

Launched on 1 April 2018, PSG supports businesses in the adoption of IT solutions, equipment and consultancy services that improve productivity. Local SMEs can apply for the Productivity Solutions Grant (PSG) to co-fund up to 70% of the qualifying costs of adopting pre-approved digital solutions. These pre-approved solutions have been assessed by IMDA to be effective, market-tested and cost-effective. The maximum funding support level has in fact been raised to 80% from 1 April 2020 to 30 September 2021, per the Supplementary Budget 2020 announcement.

EzyProcure is a pre-approved solution that specialises in F&B procurement. A one-stop Procure-to-Pay platform, EzyProcure simplifies and automates workflows, from creating orders to receiving goods, and reconciling invoices for payment. This solution also allows your F&B setup to manage inventories and perform data analytics easily, hence supporting your foray into the hawker trade with increased productivity and efficiency.

Becoming a business owner – especially a hawker stall operator – will undoubtedly come with challenges. However, all the hard work and long hours will not be without its own set of rewards. This is probably why many new hawkers have chosen to set up their own stalls instead of working in an established restaurant, preferring to be an enterprising business owner.

Now, you’re all set to start up and run your own hawker stall!

The COVID-19 pandemic has been a challenge for businesses of all shapes and sizes, but especially those in the F&B industry. With the procure-to-pay landscape having undergone considerable disruption during this unprecedented time, many F&B companies have leveraged this period to evolve how they conduct business.

With cost-efficiency becoming a primary concern for countless F&B organisations, digitising procure-to-pay processes is fast emerging way in which many forward-thinking companies have lowered costs and streamlined their operations to maximise their businesses’ performances and reduce risk of closure.

If your company isn’t using the latest digital procure-to-pay methods to seamlessly integrate its purchasing to account payable processes, you’re likely falling behind the competition. Adopting a well-designed and highly intuitive procure-to-pay solution will save your F&B business vast amounts of time, money and effort by dramatically increasing your overall efficiency and profitability.

For procurement managers and business executives in the F&B industry, COVID-19 has brought about a variety of unforeseen supply chain disruptions that have significantly impacted their ability to meet the operational demands.

As one Deloitte F&B report states, at-home product consumption has reached new heights due to working-from-home conditions, while highly profitable out-of-home consumption has almost completely halted due to restaurants and retailers either closing or downsizing during lockdowns.

Even as we begin to see the light at the end of the tunnel regarding COVID-19, a range of supply chain issues could create considerable hurdles in the short-term. With a rapid increase in demand expected as life returns to normal, most suppliers have stagnated throughout 2020, meaning many F&B businesses will face severely limited access to resources.

From transport constraints to restrictions on transient farming and warehouse workforces alongside other unexpected changes in costs, F&B businesses looking to arrive in the new normal with a clear direction must closely plan and monitor their forecast of incoming supplies.

Backed by a digitised procure-to-pay journey, F&B organisations will have an easy, economical and automated way to ensure their day-to-day procurement process runs as smoothly as possible. These organisations are able to manage the changes or irregularities efficiently with automated processes in place, with cost control management, invoice reconciliation and data analytics capabilities made available through the digitalisation enablement.

As Singapore’s COVID-19 circuit breaker measures banned dining-in at restaurants for 10 weeks, businesses navigating this challenging period

were forced to adapt to changing customer, industry and governmental expectations. Although these measures were lifted on 19 June 2020, F&B businesses have had to find ways to make up for the revenue lost during this extended period.

This has proven difficult due to widespread reliance on third-party food delivery platforms and many suppliers moving from credit payments to cash on delivery as these vendors are in turn faced with increased credit default risk pressure. These changes have led to extra costs for F&B businesses either due to additional operational fees or disruption to the supply chain. By taking a tech-focused approach to their procure-to-pay process, many F&B entrepreneurs have already started to gain positive outcomes from their cashflow optimisation and gain assurance from a streamlined distribution network.

SGeBIZ offers a unique easy-to-use procure-to-pay platform ecosystems that will help your business manage costs and optimise its performance. The first of these is EzyPayment – a payment solution which facilitates your business to “buy now, pay later”. There are a range of procure-to-pay benefits to consider but you’ll gain an advantage over the competition with 60-day interest-free credit, short payment terms to suppliers, secured transactions and enjoy potential early payment discounts from selected suppliers.

We also offer EzyProcure, a robust B-to-B F&B procurement platform that helps buyers and suppliers to effortlessly move through the order creation, goods receiving to invoice reconciliation processes with tracked labour savings of up to 70%. With the platform’s multilingual and omnichannel nature, it’s possible to auto-replenish stock levels, maintain strict budget controls and make decisions based on detailed procurement data. Best of all, it seamlessly links with EzyPayment to deliver even more automation and cashflow improvements, such that businesses can easily integrate the processes without the need for further integration.

With this uncertain time having greatly impacted the F&B industry, make sure your business is prepared for the digital-first future with SGeBIZ’s effective procure-to-pay solutions. We can help your organisation simplify procurement issues, automate workflows and achieve an economically viable journey for payments.

Smart systems might have taken over procurement and other time-consuming tasks in the Food & Beverage industry, but are you maximising your business solutions?

Sure, the main function of an e-procurement system is to handle daily order-to-invoice processes, but if you truly want to stretch your dollar and make the investment count, it might be worth exploring more functions and using them to your advantage.

For instance, have you ever thought about using records and archives to enhance your operational capabilities?

Even though they are perhaps one of the most overlooked functions in any business solution, there are tons of ways you could maximise your procurement records. Read on for 3 of them!

1. Use the Records for Forecasting

Forecasting is immensely pivotal as it helps buyers to make accurate buying decisions and manage their expenses. For a F&B business to undertake effective and high-quality procurement, prudent decision-making has a big role to play. That is why business owners have to use procurement records for better outcomes.

Moreover, forecasting goes a long way in helping buyers identify areas that require improvement as well as preparing buyers for disruptions brought about by external causes like pandemics. With enhanced forecasting capabilities, a business will be in a better position to avoid being caught off guard.

In addition, forecasting based on historical procurement records is extremely helpful in improving spend management. Referring to historical records, pinpointing areas of overspending and evaluating their spend data allows a business to improve efficiency, make better purchasing decisions and plan their spending for the long-term.

2. Improve Financial Standing

F&B business owners need to have a solid understanding of their financial positions. After all, it is important to keep profits high and costs to a minimum.

Essentially, procurement records allows business owners to obtain a bird’s eye view of their spend data and detect saving opportunities that might have been overlooked.

In other words, you have a point of reference as to where your current financial situation is, and where you want it to be in the future. In addition, as you keep procurement records, you are able to keep track of profit & loss metrics to help you make prudent financial decisions.

As a result, business owners are able to reduce unnecessary procurement expenses and keep other unnecessary costs to a minimum.

3. Recycle the Records for Training

F&B business owners can also use procurement records for training of new staff. It plays an important role in making new staff members more knowledgeable on the processes involved.

Instead of neglecting your procurement records, why not repurpose them into training materials for new staff members?

This way, new employees acquire the capacity to evaluate these processes in a more comprehensive way. They can familiarise themselves with your business’ purchase order processes. Moreover, they can take reference from past records to send purchase orders.

With adequate training and resourceful materials, they can find out what products to buy, when to buy them, and why they are buying them.

More importantly, it creates an avenue where one can take action to rectify the issues discovered and monitor the progress of procurement processes. Again, a culture of training leads to independence and the desire to learn more among staff members. This is a great asset to all F&B businesses.

If you have yet to incorporate an e-procurement system, then you need to get one, pronto! Find out more about our digital procurement solution – EzyProcure – today.

Going digital isn’t new rhetoric. Yet with the disruption brought forward by COVID-19, it has created the absolute need for organisations to allow staff to work remotely. From daily operational files to confidential documents, it’s increasingly essential for them to be easily accessible digitally while ensuring data security.

In Singapore, the government is constantly looking at “Go Digital” avenues to better support the local businesses. One of such initiatives was the Nationwide E-Invoicing Initiative launched by Infocomm Media Development Authority of Singapore (IMDA) in 2019 to help businesses improve efficiency, reduce cost, enjoy faster payment and stay green at the same time. This network is an extension of the International Pan-European Public Procurement On-Line (PEPPOL) E-Delivery Network which allows businesses to transact internationally with other linked companies. So what’s PEPPOL all about?

PEPPOL is an E-Invoicing standard that enables a standardised way of issuing and receiving electronic invoices between businesses. The PEPPOL E-Invoicing standard is a fast-growing standard adopted by many countries. With the rise of digital payment revolution, it is high time for your business to hop on the virtual highway — and E-Invoicing is a key component of smooth and efficient digitalisation of business processes. If you are new to digital payments, here is some useful information to answer your questions regarding PEPPOL E-Invoicing:

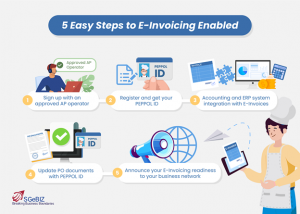

Get onboard E-Invoicing with the PEPPOL-ready service providers, catered for different business needs. List of approved Access Point [AP] operators can be found from IMDA website (www.imda.gov.sg/einvoice).

A PEPPOL ID allows you to exchange E-Invoices over the network. Register your business in the Global Directory with your UEN and obtain your PEPPOL ID (typically done by your operator).

Integrate your accounting and ERP systems to send (and receive) PEPPOL E-Invoices.

After signing up with PEPPOL E-Invoicing, the next step is to update all PO documents with your PEPPOL ID for invoicing.

Officially announce that you are E-Invoicing ready to all your suppliers and business partners. Assure them that E-Invoicing will offer greater digital efficiencies and better cash flow for suppliers.

Security and integrity of the messages exchanged through the PEPPOL network (E-Invoice Transport Infrastructure) relies on encrypted transport using SSL and additionally a Public Key Infrastructure (PKI). This ensures that only parties with valid digital certificates can communicate on the PEPPOL network. When any Access Point or Service Metadata Publisher (SMP) providers sign the PEPPOL Transport Infrastructure Agreement with IMDA they can apply for a PEPPOL Digital Certificate.

This certificate contains the key cryptographic information for validating their communications on the PEPPOL network. This ensures only known and trusted providers have access to the E-Invoice Transport Infrastructure.

No, IRAS is not able to access your invoices under current regulation. However, you do need to comply with any IRAS tax regulations, as per normal.

This is dependent on the Access Point operator that you choose. Each Access Point operator will offer different business models and value-added services, so you will need to make your own decision based on your company’s requirements.

The necessary technical specifications and resources used to implement PEPPOL-compliant solutions and services are available at http://peppol.eu/support/.

Business users should be aware that PEPPOL has been adopted as the national standard in Singapore. Businesses can tie up with any PEPPOL Access Point operator and gain access to their existing as well as potential customers across the entire PEPPOL network (i.e. connect once, connect everywhere) both locally and globally.

For those PEPPOL customers who are already using ERP and Accounting package providers, it is anticipated that they may only need minor changes or additions to their current software interfaces to make use of the PEPPOL E-Invoicing services.

Yes, E-Invoices are still valid as evidence. Singapore’s Electronic Transactions Act, Clause 6 states that “For the avoidance of doubt, it is declared that information shall not be denied effect, validity or enforceability solely on the ground that it is in the form of an electronic record.”

Additionally, the IRAS E-Tax Guide record keeping guide for GST registered businesses states the following in section 3.3.2. “Physical copies of source documents need not be kept to substantiate your business transactions for tax purposes if the source documents are kept electronically “.

Do note that businesses should ensure proper internal controls are put in place to ensure the integrity, completeness, accuracy, availability and reliability of the electronic records, including all transactions executed electronically, where applicable.

Yes, PEPPOL is an international standard. It allows you to send and receive invoices from overseas entities. Do note that this does not exempt you from compliance with any local or international regulations.

No, PEPPOL E-invoicing only covers business to business transactions, businesses to consumer transactions are currently not covered.

EzyAP is an IMDA and PEPPOL certified AP platform for E-Invoicing. You no longer need to struggle with hardcopy invoices or waste your valuable time in managing hundreds of invoices. Let EzyAP do the heavy lifting for you and make your life Ezy! Drop us a note at hello@sgebiz to find out more.

2020 has been a tough year for businesses across the board. While all businesses are struggling to keep afloat, the challenges faced by small-medium enterprises (SMEs) are especially unique. Recent research by CNBC has shown that 7.5 million small businesses across the US are at risk of closing and shutting down permanently. While in neighbouring Malaysia, a survey in March 2020 finds that nearly 70% of SMEs have lost half of their income and have suffered more than 50% drop in business during the movement control order (MCO) period.

The Productivity Solutions Grant (PSG)

In Singapore, the Government has sparked several initiatives to help struggling SMEs stay alive during the Circuit Breaker period. Most SMEs in Singapore looking for IT solutions will or already have come across the Productivity Solutions Grant (PSG), especially those looking for eCommerce solution providers. However, with so many sites offering different information, it can be confusing for any SME business owners in approaching this topic.

To further up the ante, the maximum funding support level has been raised from 70% to 80% from 1 April 2020 to 31 December 2020. PSG serves as an avenue to support companies that are keen on adopting IT solutions and make long-term technology investments to enhance their business processes. In addition to sector-specific solutions, PSG also supports the adoption of solutions that are applicable to all industries e.g. customer management, data analytics, financial management, inventory tracking, and most importantly, eCommerce solutions in Singapore.

Among the expanded solutions offered by PSG to help enterprises implement COVID-19 business continuity measures are online collaboration tools, virtual meeting and telephony tools, queue management systems, as well as temperature screening solutions. In partnership with Infocomm Media Development Authority, the scope of PSG has been enhanced to include Laptop-Bundled Remote Working Solutions for eligible enterprises from 17 April 2020 until 31 December 2020.

EzyProcure for a seamless e-commerce experience

For small and medium food industry business (F&B) owners, the PSG can be applied through EzyProcure. EzyProcure is a platform that offers an integrated system for a seamless e-commerce experience, which enables both buyers and suppliers to conduct their day to day procurement process in a smooth and timely manner. This convenient platform enables the procurement process to be fully automated, which in turn will lead to more credit and better cash flow. EzyProcure’s intuitive user interface and multilingual capabilities also make it the most convenient way to buy for your business.

EzyProcure also implements a proprietary optical-character-recognition (OCR) technology that saves 70 per cent of the manual effort required of your manpower, making work more efficient even for employees. At the end of each month, EzyProcure also produces comprehensive business analytics to assist food industry business owners in making smarter decisions for their establishment. Most importantly, EzyProcure simplifies the procurement process and automates workflow with seamless integration to backend systems.

You can apply for the PSG through the EzyProcure platform, which is linked to the EzyPayment platform. EzyPayment is the only payment facility that brings you quality credit at a low cost and lets you enjoy early payment discounts while unlocking your cashflow interest-free.