Menu

Close

- Solutions

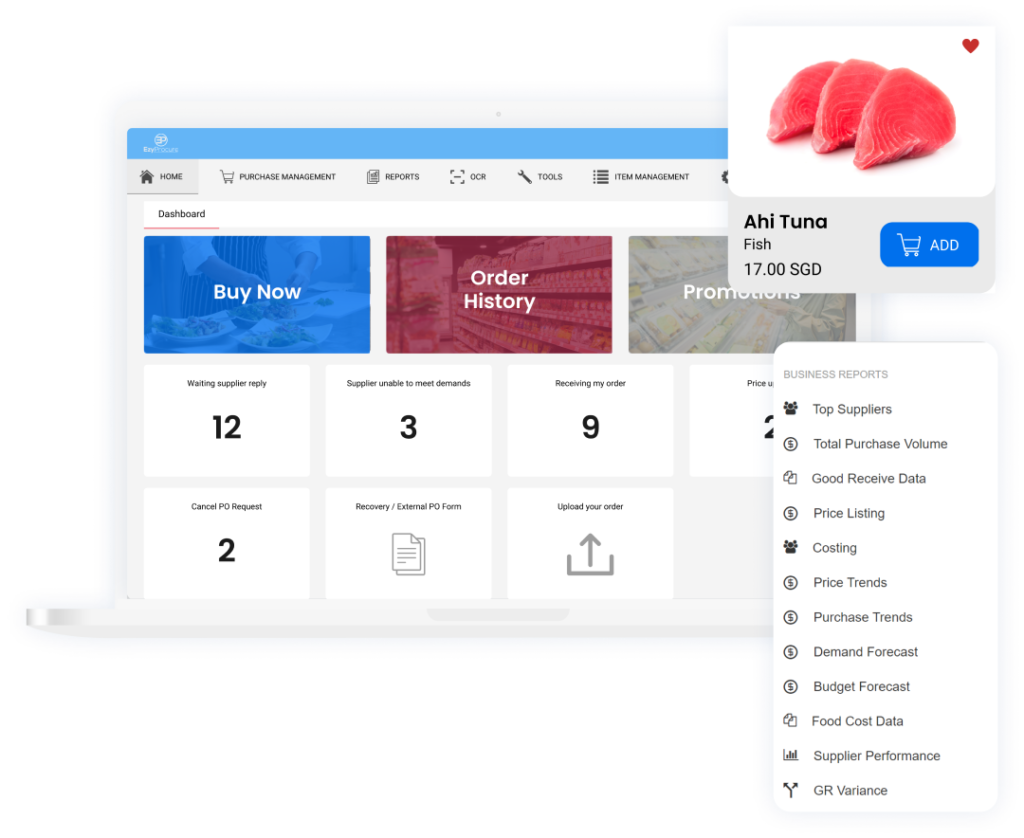

Order Management

All-in-one procurement platform

Inventory Management

Digital inventory management system

Recipe Management

Leading recipe management system

Buy Now, Pay Later (BNPL)

Get pre-approved credit of up to S$150k

EzyAP InvoiceNow

Enjoy smoother invoicing with InvoiceNow

Pay via Bank

The app for life's payments

Pay via Card

Collect payments faster and easier than before

International

Simplify cross-border payments

- Use Cases

- Promo

- Company

- Resources

Singapore

Singapore

- Solutions

Order Management

All-in-one procurement platform

Inventory Management

Digital inventory management system

Recipe Management

Leading recipe management system

Buy Now, Pay Later (BNPL)

Get pre-approved credit of up to S$150k

EzyAP InvoiceNow

Enjoy smoother invoicing with InvoiceNow

Pay via Bank

The app for life's payments

Pay via Card

Collect payments faster and easier than before

International

Simplify cross-border payments

- Use Cases

- Promo

- Company

- Resources

Singapore

Singapore